Recently, OPEC, the U.S. Energy Information Administration (EIA), the International Energy Agency (IEA), the three major energy agencies have released a monthly report, the demand forecast to make adjustments, are more optimistic expectations for global crude oil demand in 2022.

The positive impact of this news, coupled with the Fed’s September rate hike may have weakened, August 11, Brent crude oil futures rose to $ 99.60 per barrel, up 2.26% from the previous day. Demand forecasts were adjusted more specifically as follows.

| EIA | OPEC | IEA | ||||

|---|---|---|---|---|---|---|

| 2022 Whole Year | 99.4 million bpd | ↑ 210 million bpd | 100 million bpd | ↑ 310 million bpd | 99.7 million bpd | ↑ 210 million bpd |

The EIA and IEA raised their demand forecasts by 2.1 million bpd and OPEC by 3.1 million bpd. They all believe there is still room for global demand to grow this year.

OPEC, despite reporting a downward revision to its world oil demand forecast for this year, the agency’s estimated total global oil demand is higher than the IEA’s valuation. 3.1 million barrels per day of average world oil demand growth in 2022. This includes the recently observed trend of burning more crude oil in power generation.

The report forecasts an average daily oil demand growth of 1.6 million barrels in 2022 for OECD oil and 1.5 million barrels per day for non-OECD oil. Total average daily oil demand is expected to average about 100 million barrels in 2022. The global crude oil demand growth forecast for 2022 is 3.1 million bpd, down 0.26 million bpd sequentially. global economic growth forecast for 2022 is 3.1%, down 0.4% sequentially. The global economic growth forecast for 2023 is 3.1%, down 0.1% sequentially.

The IEA raised its 2022 global oil demand growth forecast by 380,000 bpd. Global oil demand is expected to increase by 2.1 million bpd in 2022 to 99.7 million bpd. The global oil supply is expected to increase by 4.8 million barrels per day to 100 million barrels per day in 2022. Global oil demand is expected to increase by 2.1 million bbl/d to 101.8 million bbl/d in 2023. The global oil supply is projected to be 101.7 million bbl/d in 2023.

The IEA believes soaring oil use for power generation and gas-to-oil conversion is boosting demand. Oil use is growing at an accelerated rate as the gas crisis drives consumers to fuel. In addition, the hot weather in Europe is also stimulating oil demand. Despite signs of a broader economic slowdown, the agency raised its global demand forecast. Showing the IEA’s more pronounced optimism about demand this year, boosting the market’s investment climate for commodities.

| Brent | Crude oil production | Crude oil demand | |

|---|---|---|---|

| 2022 | 105 | 1190 million bpd | 99.4 million bpd |

| 2023 | 95 | 11270 million bpd | 101.5 million bpd |

The EIA forecasts an average Brent crude oil price of $105 per barrel in 2022 and $95 per barrel in 2023. It also forecasts U.S. crude oil production of 11.9 million barrels per day in 2022 and an average of 12.7 million barrels per day in 2023. According to the data, U.S. crude oil production was 12.2 million barrels per day in the week ending Aug. 5, which is still 900,000 barrels per day short of the 2020 production high of 13.1 million barrels per day. Global oil and liquid fuels consumption is projected to be 98.8 million barrels in July 2022, up 0.9 million barrels from a year ago; this figure is expected to average 99.4 million barrels per day for all of 2022, up 2.1 million barrels per day from the 2021 average. Global oil and liquid fuels consumption is expected to reach an average of 101.5 million barrels per day by 2023, an increase of 2.1 million barrels per day over this year.

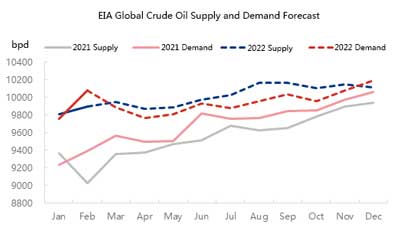

EIA Global Crude Oil Supply and Demand Forecast

According to EIA data, global crude oil demand in July was 98.83 million barrels per day, up 1.26% year-on-year, with both supply and demand significantly higher than last year’s performance. Global crude oil demand is expected to be on a growing trend this year.

In summary, the three major institutions have a positive outlook for demand, and this common position has given oil prices significant support. In addition, Europe’s summer electricity demand and tight natural gas supply may prompt more oil to be used for power generation, also boosting the crude oil futures market atmosphere, so the bottom of the oil price support is still there in the short term, and the downside channel is not yet fully open.